How much profit each country loses or attracts because of tax competition?

Between 1985 and 2018, the global average statutory corporate tax rate has fallen by about half, from 49% to 24%. One reason for this decline is international tax competition.

In this paper, Thomas Torslov, Ludvig Wier and Gabriel Zucman explore the extent to which globalization and tax competition are redistributing profits across nations. They analyze how the location of corporate profits would change if all countries adopted the same effective corporate tax rate, keeping global profits and investment constant. To do so, they exploit new macroeconomic data known as foreign affiliates statistics. As a result, the authors find that profits would increase by about 15% in high-tax European Union countries and 10% in the United States. These results can be used to quantify the tax revenues that individual countries could gain under different corporate tax reform scenarios, and to quantify the revenue implications of a formulary apportionment system.

Key-results

- Close to 40% of multinational profits are shifted to tax havens globally;

- European Union countries appear to be the tax competition largest losers: about 35% of the shifted profits come from E.U. (non-haven) countries, close to 30% from developing countries, and about 25% from the United States;

- Profitability in Local vs. Foreign Firms: foreign firms are more profitable than local firms in tax havens, and local firms are more profitable in high-tax countries;

- U.S. multinationals are the main “shifters”: about half of all the shifted profits ultimately accrue to U.S. parents, while about 30% accrue to E.U. parents;

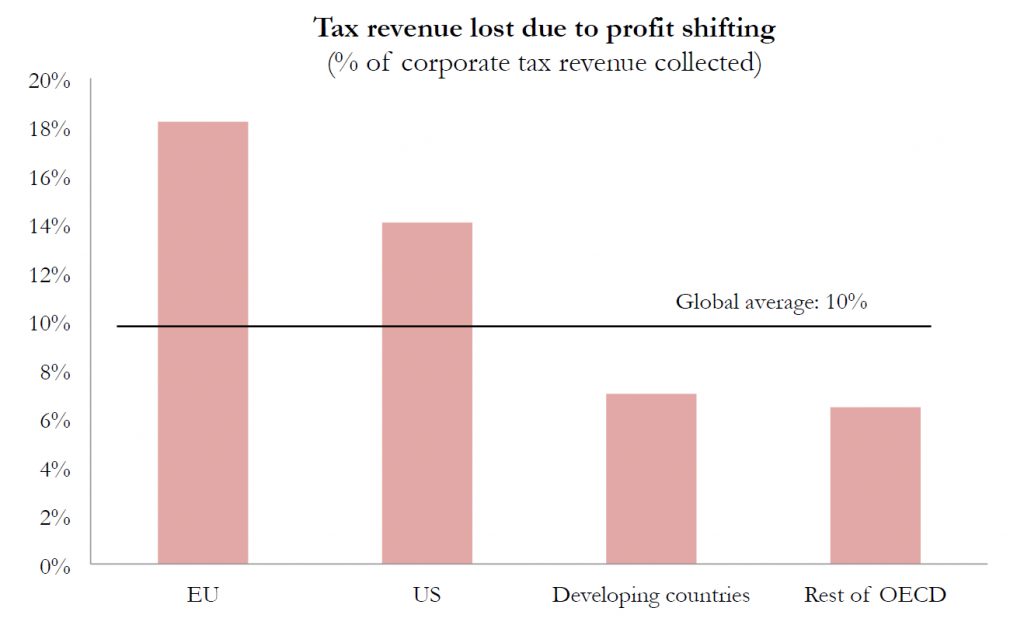

- Profit shifting reduces the corporate tax revenue of the European Union by around 20%. Globally, the tax revenue loss is around 10%;

- The havens that collect the largest amount of revenue appear to be those that impose the lowest tax rate on foreign profits: the revenue-maximizing tax rate appears to be less than 5%.

- As an example, Ireland has a 5% corporate tax rate and generates much more revenue than non-haven countries

>> Click here to read the paper

Policy conclusions

- Cutting corporate tax rates is less likely to generate quick positive effects on wages than textbook economic models suggest. For wages to rise, factors of production that complement labor need to increase. This can happen fast if tangible capital flows from abroad, less so if it is mostly paper profits that move across borders.

- Profit shifting reduces the effective rates paid by multinationals compared to local firms, which could affect competition.

- Profit shifting also reduces the taxes paid by the wealthy, as ownership of these firms is concentrated. This might call for offsetting changes in individual income taxation, or changes in the way multinational companies are taxed.

>> Missing profits – the website: Explore the map to see how much profit and tax revenue your country loses or attracts in this game for profits.

Figure

This figure presents estimates of the losses of corporate income tax revenues in high-tax countries. Results show that profits shifting reduces the corporate tax revenue of the European Union by around 20%. For the world as a whole, the tax revenue loss is around 10%.

Contacts

Authors

- Thomas Torslov (University of Copenhagen) : thomas.torslov@econ.ku.dk;

- Ludvig Wier (UC Berkeley): ludvig.wier@berkeley.edu;

- Gabriel Zucman (UC Berkeley and NBER) : zucman@berkeley.edu

Media inquiries

Olivia Ronsain: olivia.ronsain@wid.world; +33 7 63 91 81 68