WID.वर्ल्ड क्या है?

WID.वर्ल्ड और इसके इतिहास के बारे में अधिक जानकारी के लिए यहां क्लिक करें।

शोधकर्ताओं के नेटवर्क के इतिहास के बारे में अधिक जानकारी के लिए यहां क्लिक करें।

प्रविधि के बारे में अधिक जानकारी के लिए यहां क्लिक करें।

WID.वर्ल्ड के ग्राफ कैसे पढ़े जाते हैं?

WID.वर्ल्ड के मेनू और ग्राफ में कैसे नेविगेट किया जाता है, इसमें मदद के लिए यहां क्लिक करें।

WID.वर्ल्ड में मुझे तकनीकी समस्याओं का सामना करना पड़ता हैं। मुझे क्या करना चाहिए?

सबसे पहले तो हमें क्षमा करें। उसके बाद आपको चाहिए कि आप ब्राउजर की कैश मेमोरी को (जो सामान्यतः “सेटिंग/ हिस्ट्री/ क्लीयर कैश” के अंतर्गत होता है) डिलिट करें। उसके बाद उसे बंद करके दुबारा कोशिश करें। अगर इससे समस्या हल नहीं होती है, तो आप किसी दूसरे ब्राउजर को आजमाने के लिए सोच सकते हैं। अगर यह भी कारगर नहीं हो, तो हमें समस्या का विवरण तथा अपने ऑपरेटिव सिस्टम और ब्राउजर के वर्सन का ब्योरा देते हुए ईमेल भेजें। हमसे संपर्क के लिए ईमेल वेबसाइट के निचले हिस्से में “कंटैक्ट अस” (हमसे संपर्क करें) के तहत है।

WID.वर्ल्ड के असमानता संबंधी आंकड़े OECD, विश्व बैंक, या अन्य प्रोवाइडर के असमानता संबंधीआंकड़ों से किस तरह भिन्न हैं?

कुछ ही संस्थान असमानता संबंधी अनुमान उपलब्ध कराते हैं। और जो कराते भी हैं (जैसे OECD या विश्व बैंक के डेटा पोर्टल), वे अधिकांशतः पारिवारिक सर्वेक्षणों पर भरोसा करते हैं। लेकिन सर्वेक्षणों के साथ मुख्य समस्या यह है कि वे खुद की (सेल्फ) रिपोर्टिंग पर आधारित होते हैं और वितरण के शीर्ष हिस्सों की आयों तथा संपत्तियों को कम करके आंकने के लिए मशहूर हैं। इसके अलावा, सर्वेक्षणों में सीमित समय ही शामिल होता है जो असमानता संबंधी रुझानों को दीर्घकालिक परिप्रेक्ष्य में पेश करना असंभव बना देता है।

इसके विपरीत, WID.वर्ल्ड द्वारा राष्ट्रीय लेखों और सर्वेक्षणों के आंकड़ों को आंकड़ों के राजकोषीय स्रोतों के साथ संयोजित किया जाता है। इससे हमारे लिए आय और संपत्ति के मामले में सबसे नीचे से लेकर शीर्ष (सबसे ऊपर) तक के वितरण के लिए और वह भी काफी लंबी अवधि के लिए असमानता संबंधी अधिक विश्वसनीय अनुमान जारी करने की गुंजाइश बनती है।

हालांकि WID.वर्ल्ड द्वारा उपलब्ध कराई गई डेटा सीरीज को भी दोषरहित और निर्णायक के बतौर नहीं देखा जाना चाहिए। नए अशोधित आंकड़े जारी किए जाने या अवधारणा तथा प्रविधि संबंधी सुधारों के बाद वर्तमान सीरीज को WID.वर्ल्ड के लोगाें के द्वारा लगातार अपडेट और इंप्रूव किया जाता है। हमारी सीरीज के विकास के लिए अपनाई जाने वाली सारी प्रविधियों को हमारी मेथडोलॉजी लाइब्रेरी में या DINA गाइडलाइन्स में किसी खास देश से संबंधित आलेखों में देखा जा सकता है।

अगर आपको आंकड़ों के बारे में और भी प्रश्न पूछने हैं, तो हमसे बेहिचक संपर्क करें।

WID.वर्ल्ड के राष्ट्रीय लेखों के आंकड़े संयुक्त राष्ट्र (यूएन), अंतर्राष्ट्रीय मुद्रा कोष (आइएमएफ), विश्व बैंक या राष्ट्रीय लेखे उपलब्ध कराने वाले अन्य संस्थानों के आंकड़ों से किस तरह अलग हैं?

WID.वर्ल्ड पर पाए जाने वाले राष्ट्रीय लेखों (जैसे राष्ट्रीय आय और राष्ट्रीय संपत्ति) के अनुमान और अंतर्राष्ट्रीय सांख्यिकी संस्थानों के डेटाबेस आम तौर पर एक जैसे होते हैं लेकिन उनमें अनेक कारणों से अंतर हो सकता है।

एक तो हमलोग राष्ट्रीय संपदा के लेखों के लिए विस्तृत सीरीज जारी करते हैं जो सामान्यतः दूसरे पोर्टल पर नहीं उपलब्ध होते हैं। दूसरे, हम ऑफशोर संपदा और ऑफशोर पूंजीगत आय के लिए संशोधनों को शामिल करते हैं ताकि विदेशी पूंजीगत आय के आने और जाने पर हमारी सीरीज वैश्विक स्तर पर एक जैसी हों (अर्थात उनका योगफल शून्य हो)। ऐसा आम तौर पर अन्य मौजूदा डेटाबेस के मामले में नहीं होता है।

तीसरे, स्थिर पूंजी की खपत (पूंजीगत मूल्यह्रास) संबंधी अनुमानों पर विश्वसनीय सीरीज बड़ी संख्या में देशों के लिए तत्काल उपलब्ध नहीं होती है। इसलिए हमलोग विभिन्न स्रोतों को संयोजित करते हैं और एक समान वैश्विक सीरीज प्राप्त करने के लिए नई विधियां विकसित करते हैं।

फलस्वरूप, हम राष्ट्रीय आय (अर्थात स्थिर पूंजी की खपत घटाने और शुद्ध विदेशी आय जोड़ने के बाद सकल घरेलू उत्पाद) पर एक समान वैश्विक सीरीज उपलब्ध कराने में समर्थ हैं जो दूसरी किसी भी जगह उपलब्ध नहीं है।

WID.वर्ल्ड द्वारा अंतर्राष्ट्रीय तुलना के लिए 2011 के पर्चेज पावर पैरिटी (पीपीपी) राउंड का उपयोग किया जाता है। यह भी गौरतलब है कि यूरोजोन के देशों के लिए डिफॉल्ट मौद्रिक मान पीपीपी यूरो में दर्शाए जाते हैं और इसलिए वे बाजार की विपणन दर वाले यूरो से भिन्न हैं। यूरोजोन के उच्च सापेक्ष मूल्य वाले किसी देश का पीपीपी यूरो औसत आय संबंधी मानाें से कम होता है। बाजार की विपणन दरों से संबंधित मानों को हमारे कस्टम मेनू में पाया जा सकता है।

प्रविधि संबंधी इन सभी विकल्पों से समझा जा सकता है कि WID.वर्ल्ड के मान अन्य डेटा पोर्टल के मानों से थोड़े भिन्न क्यों हैं। इनका वर्णन हर वैरिएबल से जुड़े मेटाडेटा में और प्रविधि संबंधी संबंधित दस्तावेजों में किया गया है। खास कर « वैश्विक राष्ट्रीय लेखा सीरीज प्रविधि » (यहां) और « वितरणमूलक राष्ट्रीय लेखा दिशानिर्देश » (वहां) देखें।

साथ ही, यह भी गौरतलब है कि चीन जैसे ऐसे देश भी हैं जहां प्राइस डिफ्लेटर्स और समूहित वास्तविक वृद्धि के बारे में काफी विवाद है। ऐसे मामलों में हम सारी वर्तमान सीरीज की समीक्षा करते हैं और उन्हें अत्यंत संवेदनशील तरीके से संयोजित करने का प्रयास करते हैं। विशेष देश संबंधी आलेखों में इसकी पूरी व्याख्या की गई है।

अगर आपको आंकड़ों के बारे में और भी प्रश्न पूछने हैं, तो हमसे बेहिचक संपर्क करें।

पहले से ही आर्थिक आंकड़ों के अनेक पोर्टल हैं। फिर WID.वर्ल्ड का उपयोग क्यों करें?

विगत दशकों में आर्थिक असमानताओं में वृद्धि मुख्यतः वितरण के शीर्ष पर स्थित हिस्से की आमदनी और संपत्ति बढ़ने के कारण हुई। लेकिन इनकी डायनामिक्स के प्रेक्षण के लिए प्रयुक्त पारंपरिक आंकड़ा स्रोतों – पारिवारिक सर्वेक्षणों – में इसका इवॉल्यूशन बहुत अच्छी तरह कैप्चर नहीं हो पाता है। उनसे उपयोगी जानकारी उपलब्ध होती है और उनमें ढेर सारे देश शामिल होते हैं लेकिन उनसे सबसे संपन्न लोगाें की आय और संपत्ति के स्तर की पर्याप्त जानकारी नहीं मिलती है।

आंकड़ों के विभिन्न स्रोतों : राष्ट्रीय लेखों, सर्वेक्षण के आंकड़ों, राजकोषीय आंकड़ों, और संपत्ति संबंधी रैंकिंग को संयोजित करके WID.वर्ल्ड द्वारा इस सीमाबद्धता पर काबू पाया गया है। ऐसा करने से सबसे ऊपर से लेकर सबसे नीचे तक के सभी स्तरों के लिए आमदनी और संपत्ति के सारे इवॉल्यूशन की काफी स्पष्ट जानकारी पाना संभव हो जाता है। WID.वर्ल्ड परियोजना की मुख्य विशेषता ऐसे आंकड़ों का व्यवस्थित तरीके से उपयोग करना है जिससे विभिन्न देशों में बीच लंबी अवधि में भी तुलना करने की गुंजाइश बनती है।

WID.वर्ल्ड पर आपको क्या जानकारी मिलेगी और क्या नहीं, इसके लिए यहां क्लिक करें।

WID.वर्ल्ड द्वारा प्रयुक्त आर्थिक अवधारणाओं का क्या अर्थ है?

हमलोग ऐसी आर्थिक अवधारणाओं के उपयोग का सर्वोत्तम प्रयास करते हैं जो राष्ट्रीय लेखाकरण (अर्थात किसी राष्ट्र की आर्थिक गतिविधि को मापने के लिए प्रयुक्त प्रणाली) के साथ संगतिपूर्ण हो और वह आम लोगों के लिए भी सार्थक हो। हर ग्राफ पर यूजर “?” आइकन पर क्लिक कर सकते हैं। उन्हें वहां प्रयुक्त अवधाारणाओं की परिभाषा उपलब्ध होगी।

यूजर जो परिभाषा जानना चाहते हैं, उसे पाने के लिए वे हमारी क्विक सर्च ग्लॉसरी का भी उपयोग कर सकते हैं।

WID.वर्ल्ड की फंडिंग कैसे होती है?

WID.वर्ल्ड की फंडिंग पूरी तरह से सार्वजनिक, गैर-मुनाफा ऍक्टर्स के और व्यक्तिगत दानों से होती है।

हमारे फंडर्स के बारे में अधिक जानकारी के लिए यहां क्लिक करें।

अगर आप हमारी सहायता करना चाहते हैं, तो फंडिंग पृष्ठ पर दान दें (डोनेट) बटन पर क्लिक करें।

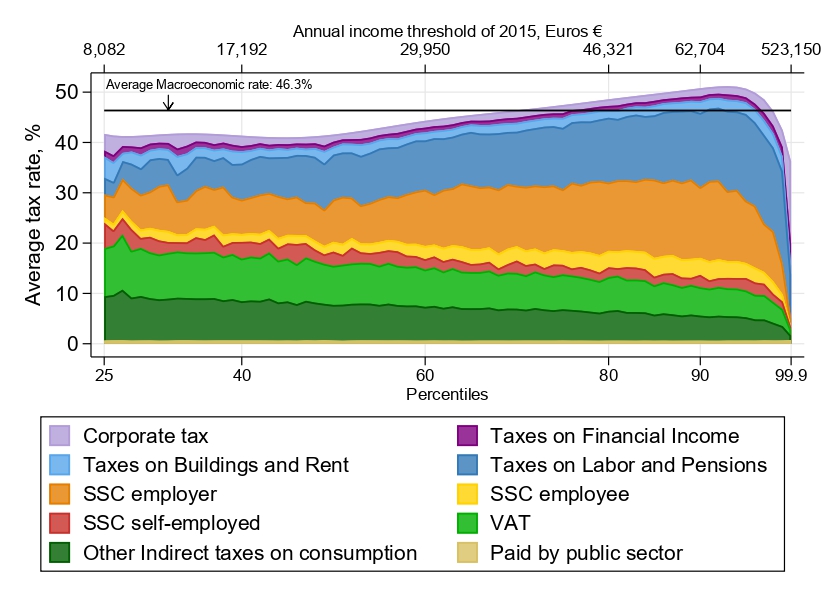

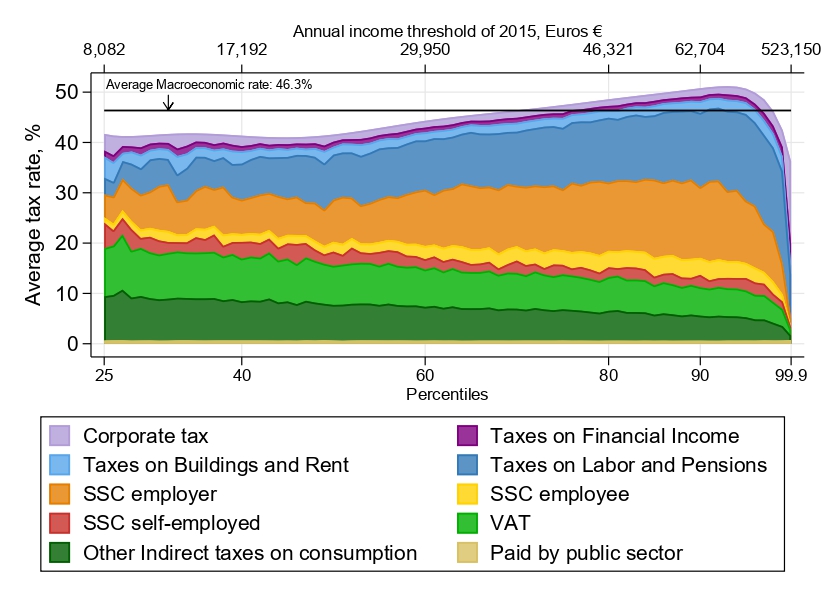

Tax rate by income percentiles, 2015

Tax rate by income percentiles, 2015 Tax rate by income percentiles, 2015

Tax rate by income percentiles, 2015