Top Income Adjustments and Inequality:

An Investigation of the EU-SILC

In this paper, Rafael Carranza, Marc Morgan and Brian Nolan use the top income adjustments produced by Blanchet et al. (2020) for 26 countries covered by the European Union Statistics on Income and Living Conditions (EU-SILC) between 2003 and 2017 to construct inequality indicators of equivalised gross and disposable household income among individuals. The authors explore the reweighted dataset in more depth, including its distribution across the population, as well as the impact of different units of observation and income concepts. They also compare their results with those of other recent studies attempting to ‘correct’ such inequality measures from the EU-SILC, namely Hlasny and Verme (2018) and Bartels and Metzing (2019), to assess whether the choice of adjustment method really makes a difference.

Key findings

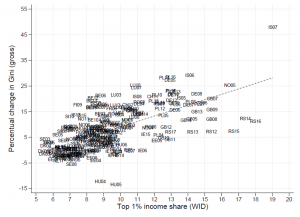

- On average, the Gini increases by around 2.4 points as a result of the top income adjustment for both gross and disposable income, with notable differences across countries, affecting rankings, despite limited impact on trends.

- There is wide variation in the adjustment across countries: the Gini is increased by up to 10 points for some countries but only very modestly for others.

- Differences in inequality depend less on the adjustment method and more on whether it relies on external data sources such as tax data.

- SILC countries that rely on administrative register data experience relatively small changes in inequality after the adjustment. For recent years, the Gini for ‘non-register’ countries increases by 2.8 points on average while in ‘register’ countries it does so by 0.9 points.

Policy recommendations

- There remains a considerable lack of clarity as to the type of register data used for each country. The type of register data used (if any) for each country in the EU-SILC should be more clearly documented.

- More comprehensive inclusion of administrative data on incomes is a priority for European statistics on income and living conditions.

- Move progressively towards a system of register data samples, including both employment income and investment income, with equivalent variables to those that exist in the SILC to preserve its richness.

Figure: Correlation between size of adjustment and top 1% income share

Contacts

Authors

- Rafael Carranza (Institute for New Economic Thinking, Oxford Martin School ; the Department of Social Policy and Intervention, University of Oxford): rafael.carranzanavarrete@spi.ox.ac.uk

- Marc Morgan (Paris School of Economics ; World Inequality Lab): marc.morgan@psemail.eu

- Brian Nolan (Institute for New Economic Thinking, Oxford Martin School ; the Department of Social Policy and Intervention, University of Oxford): brian.nolan@spi.ox.ac.uk

Media inquiries

- Olivia Ronsain, World Inequality Lab: olivia.ronsain@wid.world; +33 7 63 91 81 68

Acknowledgements

The authors thank Amory Gethin, Lucas Chancel and Thomas Blanchet for sharing their dataset, and also Charlotte Bartels and Maria Metzing for sharing their code and data. Helpful comments were provided by Facundo Alvaredo and Thomas Blanchet. This research has been supported by the European Research Council Synergy Grant 75446 for project DINA – Towards a System of Distributional National Accounts.