200 economists, researchers and campaigners from across Europe and the world gathered in Paris on 14-15 March 2024 to discuss the impact of a United Nations (UN) tax convention would have on the European Union (EU) and beyond. They emphasized that European countries stand to benefit from a UN tax convention, which could prove crucial in reducing inequalities both within and between countries.

Background

In November last year, countries at the UN have adopted by a landslide a resolution to begin the process of establishing a UN framework convention on tax, which has the potential to be the biggest shake-up of the international tax system in history. The framework convention would require global tax rules to be decided at the UN instead of the OECD, where these have been decided by a small club of rich countries for over sixty years.

Ahead of the conference, Thomas Piketty, co-director of the World Inequality Lab (WIL) warned OECD member states against further opposing a UN tax convention:

“In November 2023, the UN adopted with a very large majority the Africa Group resolution for a global convention to transform the international tax system. All BRICS countries voted yes. Unfortunately, the US, France and other rich countries from Europe and elsewhere voted no. In effect, rich countries seem to prefer to keep discussions on global tax reform in their rich club (OECD). This is a historical mistake that urgently needs to be repaired.

A global reform of the international tax system is badly needed, including a minimal tax on multimillionaires and multinationals benefiting all countries on the basis of their social needs and exposure to climate change. This requires a global forum where all world regions are properly represented.”

Why should global tax policy be decided at UN

EU countries have expressed concerns that a UN tax convention would duplicate the work of the OECD as the primary reason for their opposition to the process. The tax experts and NGOs organizing the conference argued that a UN tax convention would go far beyond the work of the OECD. They stressed that the UN’s principles of transparency, inclusivity and human rights can lead to fairer and more effective tax rules, in contrast to the OECD’s opaque and unclear decision-making process, which regularly concedes to the interests of the OECD’s tax haven members and the influence of corporate lobbyists.

Dereje Alemayehu, executive coordinator at the Global Alliance for Tax Justice, said:

“The truth is that there is no duplication: the UN is designed to facilitate globally inclusive, participatory and transparent decision-making, and the OECD is explicitly not. Rather than pretending that the world can set tax rules in a rich country members’ club which lacks transparency, inclusivity and any appropriate rules for decision-making, European leaders should fully support this inclusive and transparent negotiation at the UN, and support the UN tax convention as a historic opportunity to curb the large-scale tax abuse which their countries suffer along with the rest of us.”

Addressing inequality and global power imbalance

Norwegian State Secretary Bjørg Sandkjær and Colombian Deputy Minister of Finance María Fernanda Valdés spoke at the conference in support of the UN tax convention.

Bjørg Sandkjær, Norwegian State Secretary, said:

“The current momentum around global tax issues is very promising and this conference is testament to that. We are having a global conversation on how to tackle inequality that hasn’t happened before. Norway recognises the clear call for tax reform made by the African Group. […] More than just money, this is very much about trust”.

María Fernanda Valdés, Colombian Deputy Minister of Finance said:

“We are a developing country but also a member of the OECD. We believe our role in the discussions is to be a bridge to bring together these two worlds. […] The UN is the most legitimate place to hold universal and legally binding discussions on tax matters. We believe the agenda-setting process ensures that the interests of the Global South can be best represented at the UN. A legally binding instrument can avoid previous mistakes. A framework convention is a necessary and useful instrument, for both countries and companies”.

Gastón Nievas Offidani, World Inequality Lab (WIL) researcher, presented a paper co-written with WIL colleague, Alice Sodano, that emphasised the unfairness of the monetary systems and the structural challenges faced by developing countries. He explained:

“Rich countries enjoy a privilege on their net foreign assets. They are issuers of international reserve currencies and bankers of the world. This results in net income transfers from the poorest to the richest countries equivalent of 1% of the GDP of top 20% countries. The privilege alleviates the current account balance of the richest countries while it deteriorates current accounts of the bottom 80% by 2-3% of their GDP.

Reforming the international financial system requires the rich and powerful countries to renounce to their privilege, which is unlikely given that that the richest countries currently hold almost 70% of IMF voting power”.

Such discrepancies further underline the need for broader reform of international economic and financial governance, including on taxation.

Such discrepancies further underline the need for broader reform of international economic and financial governance, including on taxation.

Tackling tax evasion

Gabriel Zucman, Director of the EU Tax Observatory, opened the conference with a strong message on tax evasion, based on the findings of the 2024 Global Tax Evasion Report:

“Global billionaires have effective tax rates equivalent to 0% to 0.5% of their wealth, due to the frequent use of shell companies to avoid income taxation.

In 30 years will ask ourselves why did we tolerate the super-rich, the billionaires, paying so little in taxes. This is a political and intellectual failure”.

Similarly, Alex Cobham, chief executive at the Tax Justice Network, argued:

“A UN tax convention means more tax revenue for all countries, except for the most extreme tax havens. There’s more than twice as much wealth hidden offshore beyond the rule of law than there are dollars and euros in circulation today. A UN tax convention isn’t just about how we slice the cake between countries, so much as it is about stopping the cake being stolen from all of us.”

Tackling the climate and ecological crisis

The size of the global climate gap is at least 500 billion dollars per year. Research by the Tax Justice Network and the EU Tax Observatory shows that a global minimum tax on billionaires of 2% of their wealth could raise nearly $250 billion. And a strengthened 20% minimum tax on multinational corporations (with no loopholes) could generate the additional revenue needed to close this gap.

On the issue of the global climate finance gap, it is worth reiterating that the richest individuals are both the main perpetrators of tax evasion and responsible for the largest share of global emissions. Current consumption-based measures of the distribution of emissions continue to underestimate the scale of inequalities in carbon emissions.

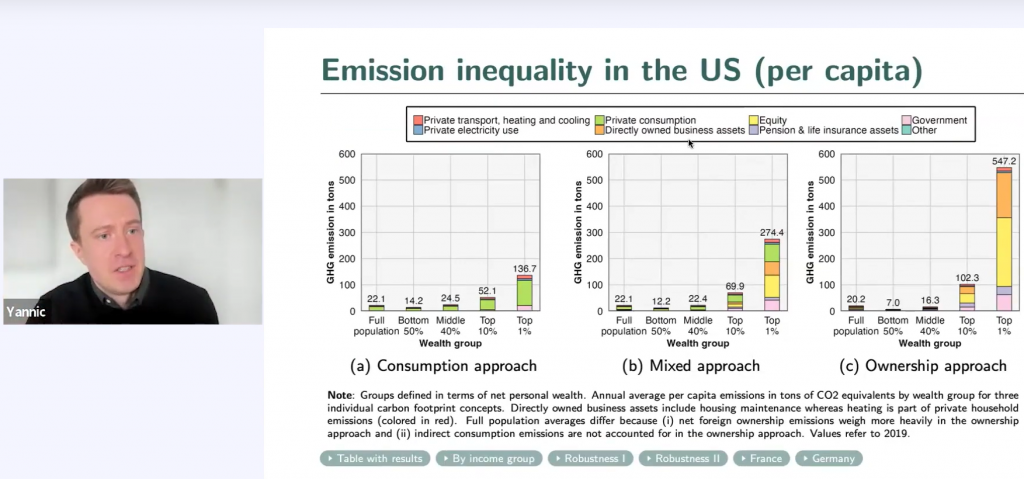

At the conference, Yannic Rehm presented WIL’s new framework to measure carbon emissions not only linked to consumption and personal lifestyles, but also the emissions associated with asset ownership (e.g. real estate, equities, or pension assets). Taking the latter into account reveals that ownership-based emissions account for a large share at the top of the income distribution. In the case of France, Germany and the US, wealth-related emissions increase the footprint of the top 10% by two or three times. This also implies that a purely consumption-based carbon tax would be regressive.

“A window of opportunity” – the way forward

Ongoing UN negotiations will culminate in a vote near the end of the year on the parameters and scope of a possible UN tax convention. If successful, formal negotiations on the terms and details of the convention will take place next year, leading to a final vote to make the convention official.

Tove Ryding, policy and advocacy manager at Eurodad, said:

“The UN track is the only track in town. How can we EU countries vote against that? This UN tax convention has been 100 years in the making. We are the lucky people that get to discuss what it looks like.”

Echoing the sentiment of a unique window of opportunity, Lucas Chancel said in his closing remarks:

“European countries have a strategic interest in engaging in these discussions in the context of the UN Tax Convention framework. Adhering to UN Tax Convention would alleviate Global South concerns regarding Western double standards and neo-colonial mindset. In addition, it is urgent to consider directing some of the revenues facilitated by new tax rules toward closing the global climate finance gap”.